Trading Skill with Example: CSCO

Can you make big money on CSCO (Cisco Systems Inc.)?

Most of stock players would hardly consider CSCO in their portfolio, unless it is for “defensive” purpose. The reason is simple: the potential growth of this stock seems very limited. People usually don’t have much patient and want to see a bigger number on the return at higher risk.

The option traders probably think differently. When they bet a stock up, let’s say a dollar, they don’t care much about how much will the stock go at 1 or 2 years later; but they do care how soon the price will reach their target and how far it will go during a short period of time.

For example, if the price of stock A is at $8 today, and I bought a call at strike price of $10 and the expiration date is 3 month later, I would only hope the price of A goes up during the 3 month. Whether the price of A went up to $20 or down to $1 after the 3 month, is not my concern at this time at all.

Suppose I was right, the price of A went up to $11. If I bought its stock, my gain would be 37.5%; if I bought its call option, my gain would at least 80%. If we think further, for the same amount of money, you can buy much more contracts than stocks; then the margin ratio for option is much much higher than the stock.

As an option player, sometimes I feel myself love those stocks such as CSCO because they are kind of stable. Its price is always shaking between curtain price ranges. Which means I have less risk and more control. If I have a longer expiration time, my investment is more predictable and the gain is still as good as at others.

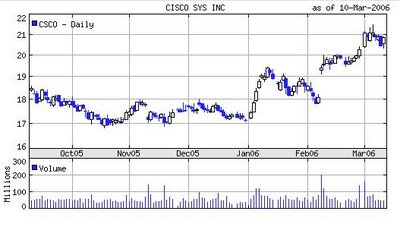

The first time I noticed there is a chance at CSCO was in my Christmas vocation. The market was pretty good in December, but the CSCO was very low still. From historic chart, we can see easily that $17 is the bottom support for a long period. An over all good market plus a blue chip stock at its bottom, was an obvious chance to bet! My first analysis showed that $19 would be the near target.

I watched the stock climbed to $19 during just a week, but did nothing because I did not have cash. The strength of the up and the volumes made me believe there is more room to growth.

When its price adjusted down to $18.2, I bough some call contracts of strike price at $20 and expiration date in Jan 2007. My initial price target was $20.10.

Its price went up and then down, even dropped below $18. Because my contracts’ expiration date is far away, I just watched them and waited for its coming up. The more fundamentals I reviewed about CSCO, the more I believe there is an even bigger turn back.

It wasn’t taken too long, the big news came out. The Cisco’s earning will be bigger than previous estimate. This news hiked the stock up a dollar. The most exiting thing to me was not $1 up, it was the 200 millions volumes. The second day of it was another 120 millions day when it once reached the $20 line. The big volumes made me believe that some institutions (who else can hold such amount of shares?) was selling off, but some other institutions was buying because they set a bigger price target!

Then I knew my initial price target should be move up too.

The $20 line was apparently the resistant line at that period. It seems some institutions were cashing their gains and some others were accumulating the shares. On Feb 27, I told a friend that once it crossed $20, it will walk into another level. When it’s happening, it would be the chance to buy.

I bought more contacts at same expiration date, but strike price at $22.5 when it stranded firmly above $20.

When the price was around $21, I sold 40% of my first purchase. The first reason of it was that I needed some cash to move to another area; the second reason, perhaps the most important reason, of it was my discipline: Always cash half of your holdings when price is up.

My first round covered 85% of my initial investment. The rest of 60% of my holdings is for perusing higher profit only.

This story is not over yet. How long would it stay above $21 line? May be the coming Monday or Tuesday, may be another week, but it is only the matter of time. I have seen enough positive signals.

It seems every whole number would slow down it a littler bit. But don’t worry! My analysis tells me that the nearest high should be around $24.35.

CSCO probably is not a good candidate for stock trading, there is little chance to double or triple your investment; but for option trading, it is.

*****

I want to emphasize what I want to say though this story:

1. A safer play for option trading is important. A blue chip stock could be a better candidate for option trading.

2. Buy a longer time is better, especially for immature

3. Set a smaller goal or price target at the beginning.

4. Patient would be paid off.

5. Watching the progress. Adjust target only when you have solid reasons.

6. When the price moving direction is favorite, adding little more investment to enlarge the benefit.

7. Under any circumstance, cash your revenue when it reached certain point.

0 Comments:

Post a Comment

<< Home