Weekly Review (3/6/06-3/10/06)

“Hi, the Market Read Your Blog!”

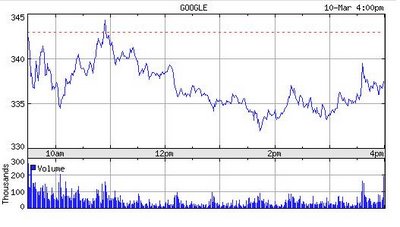

A colleague of mime said to me when we looked together at GOOG's chart during the lunch time today. Just as I said on my yesterday’s article, there was a resistant at $340. Google’s price was quickly dropped to $335 and then bounced back to $345. Because of the power of the down trend, the resistant did not take too long and the price was pushed back to $335. If we checked the chart, we can see the up and down forces were straggling for their directions.

From today’s volume, we can see the down power is strong still. Because there was a small back before closing, there is a small possibility that the up power seek for coming back to $340 though. Let’s watch it closely on Monday.

****

NYX seems read my article too. It looks like had a very good breakfast, but forgot the lunch! It quickly climbed to $88 in the morning, but then felled off in the afternoon.

I checked the news and wanted to find out its reason but could not. It mostly like a technical sell off. Today, it seems like getting support at $75. The down power seems stronger then the up’s still.

“Is the Wall Street not greedy anymore?” --- I asked myself. “Are the seat owners got out already?” --- I asked myself again. I am not sure about the first answer, but I am absolutely know the second. The seat owners are holding 110 millions (1366 * 80717 = 110,259,422) shares. The total volume of the past 3 days is less than 50 millions.

If you have shares on your hands, why do you need to worry about it? Let the big players do it; if you don't have yet, why can’t you give yourself the honor to sit besides them? (At a reasonable lower price, of course).

Because my reasons for up or down are 50:50, I cannot give you a clear short term direction at this time.

****

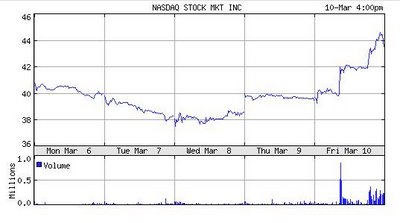

“The best reader award goes to…”--- “NASDAQ.”

If I have an Oscar, I would give it to NASDAQ without hesitation. The market really read my minds! When I wrote my paper, its closing price was $38.56; today it is $43.56. There is a $5 or 12.97% increase in two days. I am overwhelmed.

If a guy proposed to a girl and got rejected, would other people treat him as a hero and give him some bonus?

But it is what exactly happened on NASDAQ today!

The news is: The London Stock Exchange received and rejected a $4.2 billion takeover approach from the NASDAQ Stock Market Inc. This news drove the price of NDAQ up $4.06 or 10.28% to $43.56.

What can you say? “Are you crazy?” --- “No, of course not. It is the market!”

Another interesting thing you have to pay attention is the LSE’s statement: "The Board of London Stock Exchange firmly believes that the proposal, which represents only a 8 percent premium to the current market price, substantially undervalues the company, its unique position and the very significant synergies that would be achievable from the combination of London Stock Exchange with any major exchange group,"

Let me translate it to another way: The market value of LSE, which its board believes, is 4.2/0.08 = 52.5 billions.

Please refer to my article about the value of NYSE and NASDAQ. As of today, I calculated myself again, the value of NYSE is 11.78 billions; the value of NASDAQ is 3.57 billions.

So, what do you think?

For NDAQ, my analysis shows that there would be a resistant at $46.5. Its near term high is $50.

****

For this week, my projections seem work very well. It does not means I will be all correct going forward. I tried to provide very clear guidance to my readers, but you all know that it is harder and riskier, sometimes it is simply impossible. Many factors are far beyond our control. So when you doing your own investment, you have to watch the market closely and try to catch some signals as early as possible. And, the most important point is Taking Your Action.

Thank you for your time!