Weekly Review (3/13/06 – 3/17/06)

Strong Buy or Strong Sell

I would like to set a point system for better describe my suggestion. Going forward, I will use the following number to represent:

0 ----- Strong sell

2 ----- Sell

5 ----- Hold

8 ----- Buy

10 -----Strong Buy

The numbers in between will show the different meanings at different strength. For example: Hold (6) means: you should hold the stock or buy a relevant small amount because the potential price margin might not big, or the risk is bigger at this price range.

Now, let’s review the stocks that I discussed in the past.

1. INTC

During the week, I received a couple of phone calls from friends. They asked me whether they should take position because the INTC was going down. My answer was “Congratulation!” The more down means more margin you will earn in the future.

Here is the P/E ratio for the top 6 company in the Semiconductor industry. All other statistics data of INTC also show that Intel is at above average level or at top level industry wise. The fundamental analysis shows INTC is a good pick.

During the past two days, the price of INTC reached its yearly new low ($19.40). It shows the selling pressure is strong still. Technically it turned the price moving direction back down. If the panic is not over, it seems a new low is on the way.

A good fundamental vs. bad technical, plus next week’s uncertainty make me feel too difficult to give a clear prediction. But I believe the market will realize INTC’s value soon.

My suggestion: Buy (7.5)

During the next week, whenever INTC’s price dropped one level, you should increase your holding.

2. NBR

NBR is another example for good fundamental vs. bad technical. Because of its industry, Oil & Gas Drilling & Exploration, its price is strongly impacted by the oil price.

My suggestion: Buy (7)

You should watch a couple days, make sure its direction and then take a position.

3. SNDA

If you have time, you should keep an eye on it. I believe there are some interesting things going on because I found more evidence to support my doubt. Please refer to "Stock Analysis: SNDA -- Is it “Artificial”? "

Apparently it is too risky for investment at this time. I am going to remove it from my list.

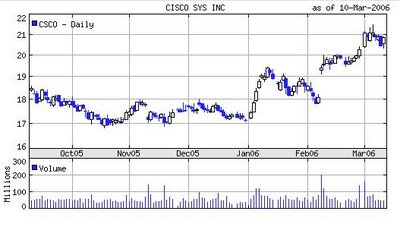

4. CSCO

CSCO had a stable gain this week. Like I said in "Trading Skill with Example: CSCO ", it is above $21 now. I believe it will keep going up.

My suggestion: Hold (6)

5. GOOG

As I predicted in "Invest on the Future -- Hi Google!", the $340 is a big resistant line. At this moment, we have not seen a clear direction change yet.

For long term, I am going to keep the down rating: Sell (2)

For short term, I think there might be a bounce. Its high should be above $360, even reach $370.

Please read my article “Trading Skill: Take Advantage from the Volatility -- Google Again! ”. It is a safe play guide to get benefit from stock such as Google.

6. NYX

Congratulation to who read my articel "Weekly Review (3/6/06-3/10/06) --“Hi, the Market Read Your Blog!”" and took action on NYX! 10% to 20% in a week is a nice margin.

It is too early to say $90 is its ceiling yet. We should watch closely on it next week. My estimation shows $107 is its ceiling, the time frame should be earlier of April. Anyway, I think buy at low and sell at high is a good strategy for it.

My suggestion: hold (6.5)

7. NDAQ

During this week, it had a high level adjustment. There should be a room for its continuously growth.

My suggestion: buy (7)

8. ELN

ELN overcame the pressure and stood above $15. It was so difficult and took too long! I am surprised that so many investors eager to sell this stock. Maybe people still wait for FDA’s final announcement.

When it was at $4, at $6, at $8, at $12, and at $14, I said “Buy” before. Today, it is at $15, I suggest “Buy” again. To reduce the risk, I suggest buy its stock or long time call.

My suggestion: buy (7)

FDA should release it’s finally decision by 3/26. The next week is an important week too. You should pay attention on the stock movement to catch any early sign of the anouncement.

Good luck to you!