What a Wonderful World!

Stock Market and Weather

“You must out of your mind!” --- A friend told me after he read my article “Look the market...” and saw what I said about the weather of New York City and the stock market.

“While, to me, the first is for fun; the second is that it is not groundless. There are reasons for it.” I said.

“You don’t want people think you are crazy, and you don’t want to destroy your reputation neither, right?”

“Yah, but my purpose is to attract people’s attention, and lead them to a new angle to view or think.”

“How can it be? How will you show the correlation between the two things that are completely irrelevant?”

“By regular statistics mean, you can not calculate or summarize a correlation between that two. But it does not mean they are irrelevant. Many factors impact on the stock market. Many factors are against each other and balance on each other. The strength of each factor is different in different period. Each factor has its own impact and power. I don’t think we can discover all factors by statistics, even a quarter of them.”

“I could agree with you, but it does not mean weather is a factor of stock market, or there will be a correlation. By the way, no superstitious, please!”

“It is not. We all know that the people would feel happier in sunny day, and get depressed when rainy. The stock market is run by the traders, analysts etc. They are human. Their feelings, mood would be impacted by the weather and expressed into the market…”

“It sounds reasonable, a little bit. How can you prove it?”

“Through statistics, I can’t. And I don’t even think to do so. There won’t be any result, I guess.”

“Then it is not a science though!”

“I don’t care what we call it. I just believe that the weather does impact the stock market indirectly. Sometimes it is strong, sometimes it is weak. Because of many other factors, people would not realize that it is even existed. Once in a blue moon, when all other factors are balanced, its impact might appear. I just think this week seems a good candidate to show such thing.”

“It still sounds very very crazy to me! You know what? Let’s just watch it next week.”

“I completely understand your feeling. I am not sure what will happen neither! Based on my analysis, the possibility is high…regardless the result, we shall learn something which is our true purpose.”

*****

Now, it is the time to review the correlation between the weather and stock market for this week.

The first picture is Dow’s five days chart; the second one is the five day weather record for New York City.

Unfortunately I cannot provide a very detailed weather record. If we compare each day’s record with its Dow’s trace, from Monday to Thursday, you would see a correlation. I think the correlation is not visible on Friday. It is OK that we cannot expect it can stand too long.

Wednesday is a perfect example for the correlation between weather and stock market!

Please let me describe the weather in more details for Wednesday:

In the early morning, there was a partly sunny momentarily; then it turned to cloudy. The sky then got darker and darker. Once a while, the outside was like in early evening. Then a light snow began, then a very heavy snow. Later on, the snow changed to a light rain. At about noon time, the rain was stopped. Then it was cloudy and sometimes we can see the sun. The afternoon was cloudy and mixed with partly sunny.

When I showed the chart to my colleague, He was so surprised by the matching of the two. They just matched so perfectly!

*****

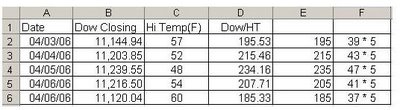

The above picture shows the following fields:

1. Column B --- Dow’s Closing number of each day

2. Column C --- The High Temperature of each day

3. Column D --- The closing number of Dow divided by the High temperature

4. Column E --- The nearest whole number of Column D

5. Column F --- The component or factor of Column E

Please look the Column F! What are they?

“39, 43, 47, 41, 37” or “37, 39, 41, 43, 47” --- They are the sequence of undividable numbers!

If we assume there is a “discipline”: the market should move sequentially. We would be able predict something. In our case, when you see the first 3 numbers on Wednesday, you can simply assume the market will try to fill out the empty spot, which is 41. --- If you do so, your guess would be right; On Thursday, you can make another guess: it will be either 37 or 53. The 53 is seems less reasonable yet, so you better choose 37. --- If you do so, you would be right again!

I just show you that if I have weather broadcast, hopeful it is correct, and then I can guess the market, isn’t it?

Why there is a '5'? --- Another interesting question.

Let me tell you: In traditional Chinese wisdom, number 5 can represents “Spring”!

…

Many times, I have been so amazed by the harmonious beauty of our mother nature!